The boycott against Target over its bathroom policy is costing the retailer more than anybody expected, as a record share price plunge and weak sales drive the big-box retailer to the brink of financial collapse.

In April last year after Target announced that it would welcome transgender customers to use any bathroom or fitting room that matched their gender identity.

Since then a determined grassroots boycott campaign has dug its heels in, and the company is having trouble hiding the financial damage.

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

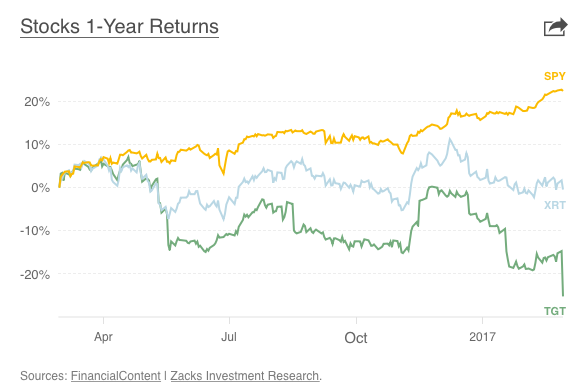

Target’s already disappointing stock price plunged a further 13 percent in early trading on Tuesday, putting the embattled retailer on pace for its worst day in almost twenty years and dragging the company dangerously close to the financial abyss.

Target also reported sales and earnings that missed Wall Street’s expectations, in what was a devastating holiday quarter for the big-box retailer.

Target’s dismal outlook for fiscal 2017 has industry experts warning if results don’t turn around – and soon – the company will go to the wall.

“Our fourth-quarter results reflect the impact of rapidly changing consumer behavior, which drove very strong digital growth but unexpected softness in our stores,” Target CEO Brian Cornell said in a statement, basically admitting the boycott has had a much stronger effect than the company expected.

Business is expected to remain tough for the fiscal year that just got underway. Target says it expects to earn $3.80 to $4.20 a share in 2017, way down on Wall Street’s expectation of $5.37 a share. That reflects expectations for a low-single digit decline in comparable sales, which will push the business to the wall if not arrested in coming months.

Angry shareholders

Target will outline its plan to revitalize its business with shareholders Tuesday morning.

At the emergency meeting, under-pressure executives will detail the new financial model for fiscal 2017, the company said.

In the company’s earnings release, Cornell teased some of the announcements Target will make at that meeting, saying the company will accelerate its investments into a “smart network of physical and digital assets” and exclusive products. They are also being forced to lower prices in a desperate attempt to lure customers back into their stores.

“We will invest in lower gross margins to ensure we are clearly and competitively priced every day,” Cornell said.

The company is also installing single-occupancy bathrooms in all of its stores to give critics of the policy more privacy – and hope the boycott campaign loses steam. The new bathrooms, which already exist in a majority of Target stores, are an expensive gamble for Target, costing the embattled retailer $20 million to install, according to Fortune.