Starbucks Corporation, the world’s leading dealer in overpriced coffee and related beverages, is teetering on the brink of financial collapse thanks to a national awakening regarding the company’s toxic values and a successful effort by conservatives to boycott the coffeehouse chain.

On Tuesday Starbucks announced plans to close 150 stores by the end of next year, sending their stock price plummeting to record lows.

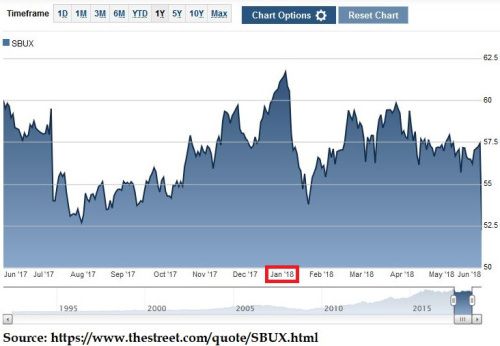

Starbucks shares fell Wednesday by 10 percent, bottoming out at their lowest point in an already disastrous 12 months, while Morgan Stanley downgraded the company’s investment rating, citing flat growth internationally and the decision to lower third-quarter U.S. growth projections from 3 percent to a “dangerously low” 1 percent.

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Starbucks shares are now down by 12.2% on the year. The stock has lagged the Dow Jones Industrial Average and S&P 500 for the better part of two years, as shareholders continue to flee the sinking ship. For corporations the size of Starbucks, falls in share price of 2 to 3 percent can have enormous ramifications. Over 12 percent? We are talking irreversible terminal decline, according to industry experts.

And the outlook is even worse for the home of the $5 latte. Based on the technical chart, according to Investopedia, shares could fall a further 16% from its current price of around $52.20, leaving the corporation beyond the point of return.

While the company has not yet said which locations will close, a notice to investors said the closures will affect “underperforming company-operated stores in its most densely penetrated markets” in urban areas.

The closure of 150 stores, coupled with the plummeting stock price, points to Starbucks teetering on the brink of irreversible financial collapse:

- The anticipated 150 store closings is up from a historical average of 50 closings per year.

- Starbucks says it expects same-store sales to grow just 1% in the next quarter. Kevin Johnson, Starbucks’ new president and CEO, said in a statement: “Our recent performance does not reflect the potential of our exceptional brand and is not acceptable. We must move faster to address the more rapidly changing preferences and needs of our customers. Over the past year we have taken several actions to streamline the company, positioning us to increase our innovation agility as an organization and enhance focus on our core value drivers which serve as the foundation to re-accelerate growth and create long-term shareholder value.”

Starbucks temporarily closed 8,000 locations, including in California, the afternoon of May 29 to offer about 175,000 employees racial bias training after the arrest of two black men at a Philadelphia Starbucks who were unpaid customers and refused to leave.

Below is a graph showing Starbucks’ one-year stock performance and, beneath that, since 1990. Note that something happened in January 2018 which led to the company’s stocks plummeting.