British investment banker Lord Rothschild says that the world is seeing the greatest monetary policy experiment in history.

Massive amounts of quantitative easing, negative yields on government debt and low interest rates have put the world in the midst of the biggest financial experiment in history.

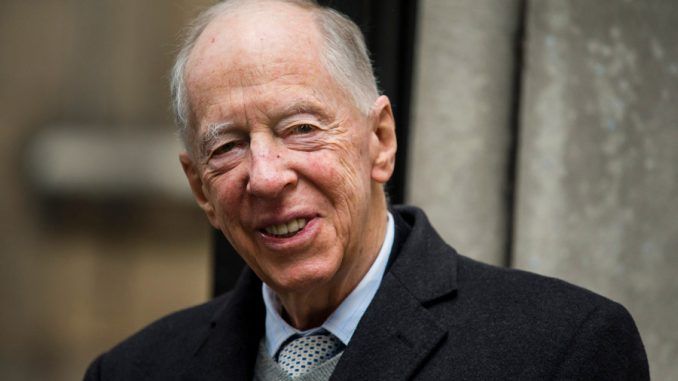

The chairman of RIT Capital Partners and a member of the prominent Rothschild banking family, Lord Jacob Rothschild, says that we are in “uncharted waters” with many risks facing the global economy.

RT reports:

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

“The six months under review have seen central bankers continuing what is surely the greatest experiment in monetary policy in the history of the world. We are therefore in uncharted waters and it is impossible to predict the unintended consequences of very low interest rates, with some 30 percent of global government debt at negative yields, combined with quantitative easing on a massive scale,” Rothschild writes in the company’s semi-annual financial report.

The banker notes this policy has led to a rapid growth of stock markets – US stocks have grown threefold since 2008 – with investments growing and volatility remaining low.

However, the real sector of economy didn’t enjoy such a profit, as “growth remains anemic, with weak demand and deflation in many parts of the developed world,” according to Rothschild.

The greatest monetary experiment in history.

Incredible share via: https://t.co/kZNqfBbQlv$USDJPY $DAX pic.twitter.com/bp4GEclZGV

— StockTwits (@StockTwits) August 16, 2016

The billionaire underlined that many risks remain for the global economy with the deteriorating geopolitical situation. Among those risks Rothschild included Britain’s vote to leave the European Union, the US presidential election, and China’s slowing economic growth. Another risk is global terrorism, which Rothschild says is a consequence of the continuing conflict in the Middle East.

According to a Bank of America Merrill Lynch report in June, interest rates in developed countries, in particular America’s 0.5 percent, are now at the lowest level in 5,000 years. In their battle against deflation, countries such as Sweden, Switzerland or Japan have even turned to negative key lending rates.

Interest rates are the lowest in 5000 years! One strong reason to be a net net investor. pic.twitter.com/99M6cd0XJl

— Evan Bleker (@netnethunter) July 25, 2016

Another woe is negative yields on government bonds. In June, 10-year German government bonds dipped below 0 percent for the first time in history. Janus Capital has estimated that global yields are the lowest in 500 years, and the total amount of such bonds is $10 trillion. The investment group’s lead portfolio manager, Bill Gross, is calling it a “supernova that will explode one day.”

Gross: Global yields lowest in 500 years of recorded history. $10 trillion of neg. rate bonds. This is a supernova that will explode one day

— Janus Capital (@JanusCapital) June 9, 2016

Edmondo Burr

CEO

Assistant Editor

Latest posts by Edmondo Burr (see all)

- Police Arrest Suspect In Supermarket Baby Food Poisoning - October 1, 2017

- Seoul Secures Data From Electromagnetic Interference By N Korea - September 30, 2017

- The ‘World’s First Internet War’ Has Begun: Julian Assange - September 30, 2017

IF /When banks fail I say freeze all of the ROTHCHILDS money and make the world whole !! They amongst others are the head of the VIPER !@

since 5000 years, you menan money lender inside the temple

political dogma and religious dogma screw everything up espiecialy now that sex dogma and blackmail drive those two…..on the road too oblivion