The New World Order is motivated to continue to see our national and world debt increase because the government then becomes their servant.

The national debt is spiraling out of control, governments continue to leverage themselves by imposing greater taxes on the people, and the gap between rich and poor is at an all time high. The elite continue to push an agenda that becomes scary for the rest of the world, but becomes more enticing for them to gain power and prestige.

Investment Watch Blog Reports:

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

According to the Institute of International Finance, global debt has now reached a new all-time record high of 217 trillion dollars…

Global debt levels have surged to a record $217 trillion in the first quarter of the year. This is 327 percent of the world’s annual economic output (GDP), reports the Institute of International Finance (IIF).

The surging debt was driven by emerging economies, which have increased borrowing by $3 trillion to $56 trillion. This amounts to 218 percent of their combined economic output, five percentage points greater year on year.

Never before in human history has our world been so saturated with debt.

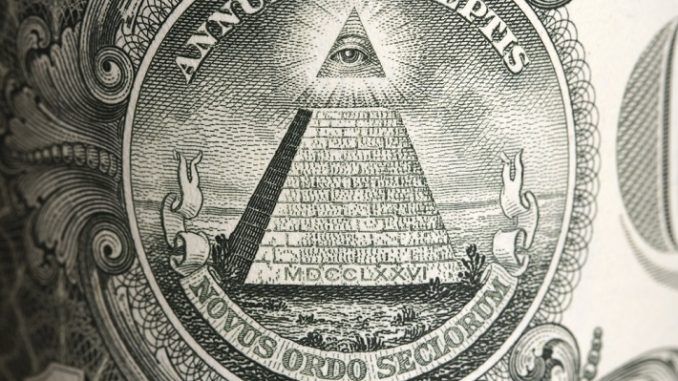

And what all of this debt does is that it funnels wealth to the very top of the global wealth pyramid. In other words, it makes global wealth inequality far worse because this system is designed to make the rich even richer and the poor even poorer.

Every year the gap between the wealthy and the poor grows, and it has gotten to the point that eight men have as much wealth as the poorest 3.6 billion people on this planet combined…

This didn’t happen by accident. Sadly, most people don’t even understand that this is literally what our system was designed to do.

Today, more than 99 percent of the population of the planet lives in a country that has a central bank. And debt-based central banking is designed to get national governments trapped in endless debt spirals from which they can never possibly escape.

For example, just consider the Federal Reserve. During the four decades before the Federal Reserve was created, our country enjoyed the best period of economic growth in U.S. history. But since the Fed was established in 1913, the value of the U.S. dollar has fallen by approximately 98 percent and the size of our national debt has gotten more than 5000 times larger.

It isn’t an accident that we are 20 trillion dollars in debt. The truth is that the debt-based Federal Reserve is doing exactly what it was originally designed to do. And no matter what politicians will tell you, we will never have a permanent solution to our debt problem until we get rid of the Federal Reserve.

In 2017, interest on the national debt will be nearly half a trillion dollars.

That means that close to 500 billion of our tax dollars will go out the door before our government spends a single penny on the military, on roads, on health care or on anything else.

And we continue to pile up debt at a rate of more than 100 million dollars an hour. According to the Congressional Budget Office, the federal government will add more than a trillion dollars to the national debt once again in 2018…

Unless current laws are changed, federal individual income tax collections will increase by 9.5 percent in fiscal 2018, which begins on Oct. 1, according to data released today by the Congressional Budget Office.

At the same time, however, the federal debt will increase by more than $1 trillion.

We shouldn’t be doing this, but we just can’t seem to stop.

Let me try to put this into perspective. If you could somehow borrow a million dollars today and obligate your children to pay it off for you, would you do it?

Maybe if you really hate your children you would, but most loving parents would never do such a thing.

But that is precisely what we are doing on a national level.

Thomas Jefferson was strongly against government debt because he believed that it was a way for one generation to steal from another generation. And he actually wished that he could have added another amendment to the U.S. Constitution which would have banned government borrowing…

“I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its Constitution; I mean an additional article, taking from the federal government the power of borrowing.”

And the really big secret that none of us are supposed to know is that governments don’t actually have to borrow money.

But if we start saying that too loudly the people that are making trillions of dollars from the current system are going to get very, very upset with us.

Today, we are living in the terminal phase of the biggest debt bubble in the history of the planet. Every debt bubble eventually ends tragically, and this one will too.

Bill Gross recently noted that “our highly levered financial system is like a truckload of nitro glycerin on a bumpy road”. One wrong move and the whole thing could blow sky high.

When everything comes crashing down and a great crisis happens, we are going to have a choice.

We could try to rebuild the fundamentally flawed old system, or we could scrap it and start over with something much better.

My hope is that we will finally learn our lesson and discard the debt-based central banking model for good.

The reason why I am writing about this so much ahead of time is so that people will actually understand why the coming crisis is happening as it unfolds.

If we can get everyone to understand how we are being systematically robbed and cheated, perhaps people will finally get mad enough to do something about it.

Jesus ran the USURY money changers out of the temple, so they set up shop at the Vatican, the CITY of LONDON, Wall Street, Not Federal and no Reserve(s), Washington DC, BIS.

Debt is how (((they))) rule and they own more by the day. White Europeans built the western world and the Jew bought it all with ink and paper.

The Money Masters – Full Length Documentary

https://www.youtube.com/watch?v=KZXSao-MDDI

NEW WORLD ORDER – Communism By The Backdoor

http://communismbythebackdoor.tv/

The Greatest Story NEVER Told – The Untold Story of Adolf Hitler

http://thegreateststorynevertold.tv/

During the previous administration, I wrote “The Way Out” to show how the federal government could end the debt crisis permanently and even use the Federal Reserve to help manage the process. This I thought to be a better strategy than challenging the Federal Reserve System or the politicians directly. However, there have been nearly no sales of that book and therefore no popular upswell to demand that its program be put in place.

The Way Out: How Electronic Revenue Credits Can: End the Debt Crisis, Open Government and Restart the Economy https://www.amazon.com/dp/1934882046/ref=cm_sw_r_cp_api_Y35vzbNWWCKH0

Some have suggested that I offer “The Way Out” for free, but I had already done so. There were a few copies of the electronic version distributed, which ranked it moderately high in some not very popular categories for free e-books. The free rankings are separate from the regular rankings, so there was no visibility for the e-book from those offerings, and therefore none for what became the trade paperback first edition.

The importance of all of this talk about Amazon rankings is that they have been the premier avenue for online and therefore unattended and massive sales. These are the sales which can get “The Way Out” before millions of eyes. If you have read this far, you are a member of a minute fraction of the online population that would read the first few pages of an exposition which was intentionally brief. The millions of social media eyes which the most successful memes capture would never follow the argument of “The Way Out” to its conclusion and therefore never understand it, let alone endorse it with great urgency.

It falls then to you, intrepid readers of this comment, to procure a copy of “The Way Out”, to read, mark and inwardly digest its exposition, and, if you are convinced by that exposition, become its apostles among those getting books online, as well as advocates for its placement in local bookstores and libraries.

For my part, I will try to schedule a few, local book signings, if I can manage to get away from my day job as an underpaid, over-qualified software developer and maintainer for a few hours.