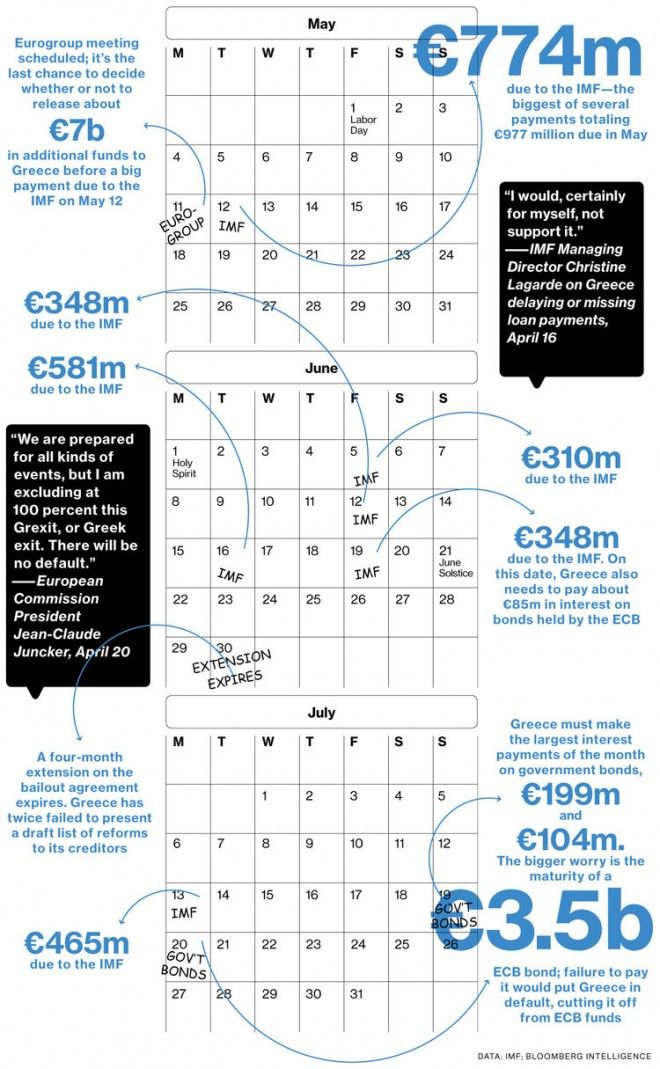

Following Greece’s first transfer of €750m (£544m, $834m) in debt interest to the International Monetary Fund (IMF) on Monday, contingency plans are being made by the IMF for a Greek default on their debt.

A senior official has said that the IMF is now asking neighbouring banks to ensure ensure that subsidiaries of Greek banks have enough assets that they can exchange for emergency financing at their own central banks—in case financing from their parent institutions is suddenly cut off—and that deposit-insurance funds are at sufficient levels, Mr. Decressin said.”

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Zerohedge.com reports:

In other words, have a Greek default Plan B ready, preferably right now.

“We are in a dialogue with all of these countries,” said Jörg Decressin, deputy director of the IMF’s Europe department. “We are talking with them about the contingency plans they have, what measures they can take.”

Greek banks are big players in some of its neighbors’ financial systems. In Bulgaria, subsidiaries of National Bank of Greece SA, Alpha Bank SA, Piraeus Bank SA and Eurobank Ergasias SA own around 22% of banking assets, roughly the same as Greek banks own in Macedonia. Greek banks are also active in Romania, Albania and Serbia.

Should anyone be worried that a day before the critical Eurozone meeting which was supposed to conclude the Greek bailout negotiations, not only is there not a deal but Greece is once again on the edge of collapse?

“It would be foolish for anyone in the policy world not to be worried at this stage,” Mr. Decressin said.

Thanks for the warning.

And while we have covered the background story in detail, here it is again: “European officials expect no breakthroughs at a meeting of the currency union’s finance ministers on Monday. That means Greek lenders will remain under pressure, dependent on relatively expensive liquidity from the Greek central bank and at risk of bank runs in case doubts emerge over their ability to pay out deposits.”

As noted above it is not if, but when. Here’s why.

Going back to the WSJ story, while there is nothing that has actually changed in the narrative, it is almost as if the IMF, having failed to spur a wholesale bank run in Greece, one that would have toppled the government, is now trying to spur bank runs in Greek bank subsidiaries in neighboring nations.

One scenario that the IMF is concerned about is what could happen if panic over Greece’s finances pushes savers in the region to pull their money out of Greek-owned banks. “These banks…may be totally fine, but there could still be in the population a perception, these are Greek banks and they are not fine, and people would turn up and try to withdraw their deposits. That is something you cannot model,” Mr. Decressin said.

National safety nets have in the past been vulnerable to rumor-fueled bank runs. In June last year, the Bulgarian government had to take over Corporate Commercial Bank, after depositors pulled out their savings amid negative news reports about the lender’s main shareholder. It took the government six months to compensate the bank’s depositors, far longer than the 25 days mandated under European Union law.

Of course, if there is a Greek default and suddenly it becomes clear to everyone that the unbreakable monetary union is quite, well, breakable, the IMF will have to worry not about bank runs in Bulgaria et al, but the countries in Europe’s periphery, such as the one with the second largest amount of sovereign debt outstanding: Italy, as well as Spain, Portugal and so on. Because if the common people have learned one thing, it is that if a political party is elected that the ECB does not approve of, that country’s days of financial mirth are over, and insolvent reality is just around the corner.

And just to make sure that the IMF’s concerns are unwarraned, the NYT reports that “discussions in the Greek government have included assessing the pros and cons of not paying the central bank and the monetary fund, said two people who were briefed on the discussions but who spoke on the condition of anonymity. In such a case, which was described as a last-ditch option and not a plan for action, Greece would keep paying debts owed to private sector bondholders and other European governments.”

What is most shocking is that it has taken the Greeks five years to realize there are no more pros to perpetuating the massive con that is it failed zombie nation status, one that has resulted in the biggest national depression in history.

Be the first to comment