A reporter from Bloomberg business was mystified when he got a bill from his hotel while reporting on the Greek economic crisis and was billed in Drachma – the new currency that those in the Eurozone have been trying to avoid at all costs.

Some are panicking over this information, confirmed with a laughing, smiling report on Bloomberg’s video site. A poster on the forum GodLikeProductions.com [1] named ShockJock [2] broke the news on the forum, adding his own thoughts:

“There will be NO DEAL between Greece and its European Creditors; NO DEAL, NO BAILOUT, NO ADDITIONAL ECB LIQUIDITY

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Businesses and Banks within Greece have already been told to immediately commence a currency switch to the soon-to-be-re-issued Greek Drachma and, accidentally, some merchants have already begun invoicing customers in the new Drachma currency! This Invoicing in Drachmas has been CONFIRMED by Bloomberg Business News and their coverage can be seen HERE: [link to www.bloomberg.com]

Once the Eurozone officially announces NO DEAL, Greece will exit the European Union, RENOUNCE and REPUDIATE ITS DEBTS, and will begin a series of deliberate DEFAULTS on External Bonds delineated in Euros!

This will absolutely, positively trigger Credit Default Swaps, triggering the immediate failure of several large banks in Europe and perhaps even in the United States.

This is a done deal. Everything taking place now – allegedly some new plan and hope for a third bailout — is all theater.”

Of course, this is just one person’s opinion of what could be a small clerical error could mean. However, as Bloomberg reporters point out in the video seen here, a LOT of companies would have to be involved and are involved in any transaction of this type before the bill would be delivered to a customer. TRANSLATION: SOMEONE, SOMEWHERE knew what they were doing when the currency changed, somehow, from Euro to Drachma.

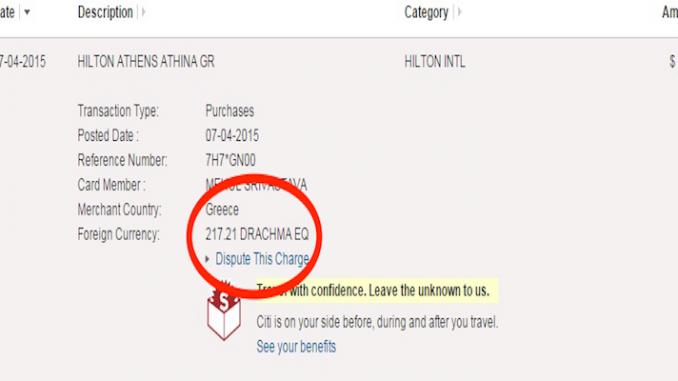

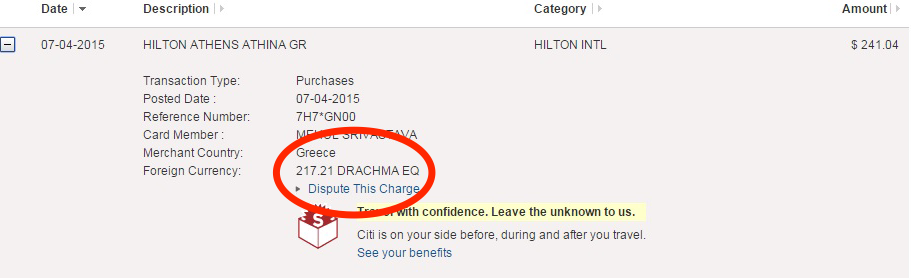

The Bloomberg reporter was staying at a Hilton in Athens from June 28 to July 4, 2015 and the transactions from his CitiGroup credit card were posted in “Drachma EQ”.

Bloomberg reports [3]:

The inexplicable notation — bear in mind, the euro remains Greece’s official currency — flummoxed two very polite customer service representatives and spokesmen for the companies involved. It depicts a currency changeover that the Greek government and European officials have been working for over six months to avoid.

Banks around the world are bracing for the increasingly real possibility that Greece may be forced to abandon the euro, a currency it shares with 18 other European countries. European negotiators have given Prime Minister Alexis Tsipras until Sunday to work out a final deal of austerity and economic reforms in return for more financing.

Citigroup and Visa Inc. declined to comment. A Hilton Worldwide Holdings Inc. spokeswoman said that the Athens hotel had billed the customer in euros, not drachmas.

The amount was the same as it would have been in euros, implying parity with the single currency — a possibility that economists have discounted as unlikely. Were Greece forced to reintroduce the drachma, its value would likely fall quickly versus global currencies, given the imbalance between Greek imports and exports and its economically unsure future.

Figuring out how the currency switch happened proved fruitless, in part because of the nature of the credit-card business. Each time a consumer swipes a card, information passes between four parties: a merchant, the merchant’s bank, a network like Visa or MasterCard Inc. and the consumer’s bank.

The merchant’s bank — called an acquirer — works directly with a store, restaurant or hotel to help them accept cards, and processes transactions on their behalf by exchanging funds with the consumer’s issuing bank via a network. Hilton declined to provide the name of its acquirer.

While computer systems at banks and credit-card processors would have to adapt quickly to allow cross-border transactions in a new drachma, the introduction of paper money would take a longer. Introducing a new currency typically takes at least six months and sometimes as long as two years, Ralf Wintergerst, head of banknote production at Giesecke & Devrient GmbH, a Munich company that has printed banknotes since the days of Germany’s Reichsmark in the 1920s, said last week.

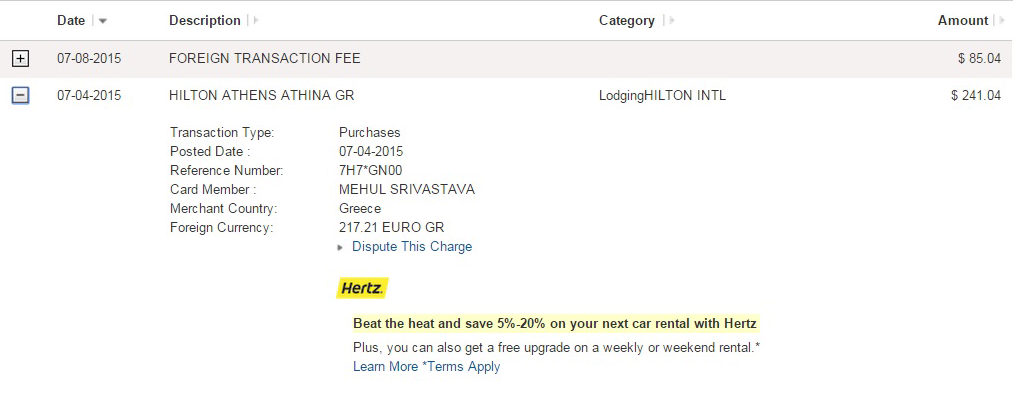

The response to the drachma billing mystery was more rapid. A day after Bloomberg began making calls asking about what might have happened, the reporter’s online statement was changed. It now looks like this:

So, what does this all mean? It could very potentially mean that business have already been told to switch over to the new currency and we have a massive financial collapse on our hands. If no deal has been made, then many are already beginning to see how Greece’s financial disaster will affect not only Europe, but everyone in the global economy.

*AUTHOR’S NOTE TO READERS: IN CASE BLOOMBERG CHANGES OR DELETES THEIR STORY, I HAVE UPLOADED A .PDF VERSION OF THE ARTICLE AS IT STOOD WHEN FIRST PUBLISHED, WHICH CAN BE ACCESSED BY CLICKING HERE BLOOMBERG- First Sighting of Drachma in the Wild, Via Credit-Card Mystery – Bloomberg Business OR HERE: First Sighting of Drachma in the Wild, Via Credit-Card Mystery – Bloomberg Business.

Sources:

[1] http://www.godlikeproductions.com/forum1/message2899318/pg1

[2] http://www.godlikeproductions.com/members/173747/profile